Rating

Introduction

M1 Finance is an online investment platform that offers tools and resources to help users manage their investments. M1 Finance allows users to create customized portfolios and access a range of investment options, including stocks and ETFs.

Have you ever felt like your money was not working as hard for you as you worked for them? I know I have. I was investing through different platforms, but I was never satisfied when some hidden fees popped up, or the system was not working.

I also know that many others have been in the same position as me. This is why I have decided to write an honest M1 Finance review! I was incredibly surprised by what this young company could do and how my investments were suddenly yielding greater results.

Overview: M1 Finance

When I first signed up for this platform, I was not sure what to expect. At first, I thought that it could not have been much different from similar competitors, but it really surprised me! Both the system and the app boasts essential features that make M1 Finance unique in the field.

Let’s have a look at what you should be expecting when launching this app on your phone!

Is It Easy To Use?

M1 Finance aims at covering all aspects of your finances. The design and navigation are incredibly easy to understand, and they are perfect for first-time investors.

If you have just started off your trading career and you are confused by schemes, lines, arrows, and technical terms, this straightforward company can really help you deepen your current understanding. All processes, including signing up and investing, have been simplified for you to get the best of both worlds.

Is The Brokerage Free?

If you are not sure how much you will be investing, or you are already a frequent trader, the one thing you will be trying to avoid is fees. Commission, membership, signing-up fees can represent a huge cost, especially if they are applied for every transaction. This is why all services offered by M1 Finance are designed to be free.

Moreover, they will look after you with optional, free of charge, professional consultation. Here you can have the chance to speak to a specialist and express what your goals are. In this way, you can deepen the knowledge of this field and set yourself up for success.

Lastly, there is no minimum investment required. This can be an important factor when picking a trading platform. Personally, this freedom that M1 would give me was what made me pick this particular company. Especially if you have just started off in the field, you will not feel pushed to involve more capital that you were willing to.

How Customizable Is The Service?

Not all money is the same, and we all definitely want different things. This is why the whole system can be customized and tailored to the level of risk you are willing to embrace, your future goals, and your expertise.

You will be asked basic information when signing up, and the platform will adapt to your needs. For example, if you are a beginner and are not willing to tolerate a high level of risk, the platform will adjust to suggest safer investment options.

The App: Features and Benefits

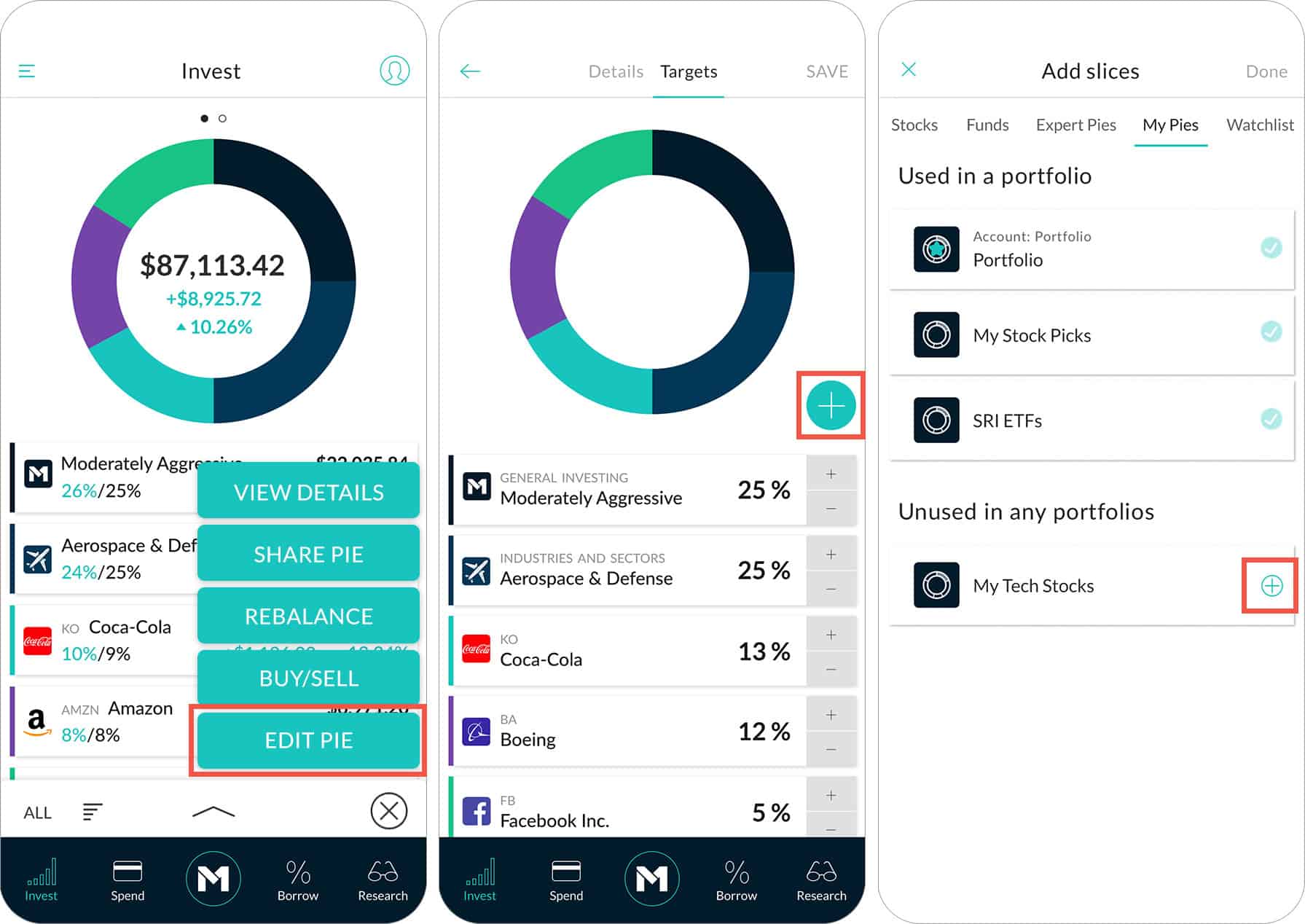

The M1 app has been designed to offer the highest accessibility possible to all users. It has been streamlined to offer the essential information needed at a glance, but it also offers a lot more than that.

1. The “pie” system

The pie system has been designed by M1 Finance and took inspiration from the theories of behavioral finance and portfolio.

You can get your own pie just by following some simple and preliminary steps. After answering the questions asked by the app, you will be able to admire your investment pie!

I can tell you it is definitely satisfying!

Your pie will reflect your financial behavior and show you the distribution of private investments and holdings. The different sections of the pie indicate the different investment categories you should look into. Through this system, you can see your performance, price history, expense ratios, and more.

The first pie will be suggested for you based on your answers. You will be matched with the investment strategy that can help you reach your goal faster and safer. After your investments, you will see your pie’s section to be adapting to show your investments and actions.

2. The best benefit: automatic rebalancing

If you have just started trading and investing like I was when I signed up for M1 Finance, you are probably worried about falling out of balance. However, through the pie system, you won’t need to know much about technical terms, as you will immediately notice when your pie is out of balance. In this case, the most effective tactic is to sell your heavier asset class and buy more assets of the class that is thinner.

While noticing the imbalance and achieving and maintaining the balance can be a job for a more expert investor, the M1 app is there to help you throughout. The system will maintain the balance automatically for you.

Moreover, the services offered by M1 allow you to buy a fraction of a share. This is impossible in many other investment platforms, but it can be extremely convenient if you don’t have enough capital to invest, or you don’t feel safe while proceeding to a large investment.

3. Other services: M1 Spend and Borrow

Being FDIC-insured, the M1 spend checking account is fully integrated within the platform. Even with the free, lower tier of this service, you will be able to receive pay-checks, pay bills, and complete a debit card transaction.

Alternatively, M1 Borrow is a unique way to finance your upcoming expenditure and investments. The service offers some of the lowest interest rates on the market and can be used to start a mortgage or request a loan.

At A Glance

- Price – free

- Account minimum – $0

- Investment minimum – $0

- Promotion – invest for free

- Accounts types: Individual taxable, joint accounts, trusts, Roth IRA, traditional IRA, Rollover IRA, SEP IRA

- Portfolio Rebalancing: Yes

- Can I get advice: yes but it is automated

- How do I access the system? The app can be downloaded on IOs and Android devices. The data can also be accessed through the website.

Investment categories:

- General Investing: your risk tolerance and goals are taken into consideration

- Plan for Retirement

- Responsible Investing: Perfect to do something good for both yourself and the community

- Income Earners: your portfolio is based on income and dividends.

- Hedge Fund Followers

- Industries and Sectors: you can pick a specific sector to invest in.

- Just Stocks and Bonds

Who is M1 Finance for?

If you have been struggling to find investment management companies that protect you and help you through your trading journey?

Do you feel like you need advice for cash management, investment decisions, and borrowing alternatives?

Are you tired of paying continuous commissions on stock trading, memberships, and accounts?

M1 Finance solves all of these problems and more. If you are the sort of user that wants to be able to check the investment and status of your finances at all times, the app developed by this company can really help you in this matter. It is easy to get advice for managing cash flow and smart investing and borrowing through this platform, especially if you are a first-time investor.

Pros

Cons

Conclusion

M1 offers an innovative concept which can be extremely beneficial to determine what your investment plan will be. Especially if you are a beginner in the investment sector, the Pie system boosted by this company can help you get a clearer idea about your financial behavior.

The app is easy to use and free, so I would recommend anyone to try it out and check whether it is the right system for you. Check it out and let us know what you think!

Trading Review’s mission is to help you become a better and smarter trader/investor through in-depth reviews of courses, trading software, and more.