Stock screeners are to stock traders what rangefinders are to golfers. They not only help you pinpoint opportunities but also give you a competitive edge when you badly need it.

Talking about stock screeners, Finviz and Tradingview are two of the most popular ones out there. So far, debate has been raging on which one of them is the G.O.A.T. We decided to settle this battle once and for all – here’s our detailed comparison of the two.

TradingView

Overall Rating: 4.3/5

Finviz

Overall Rating: 4/5

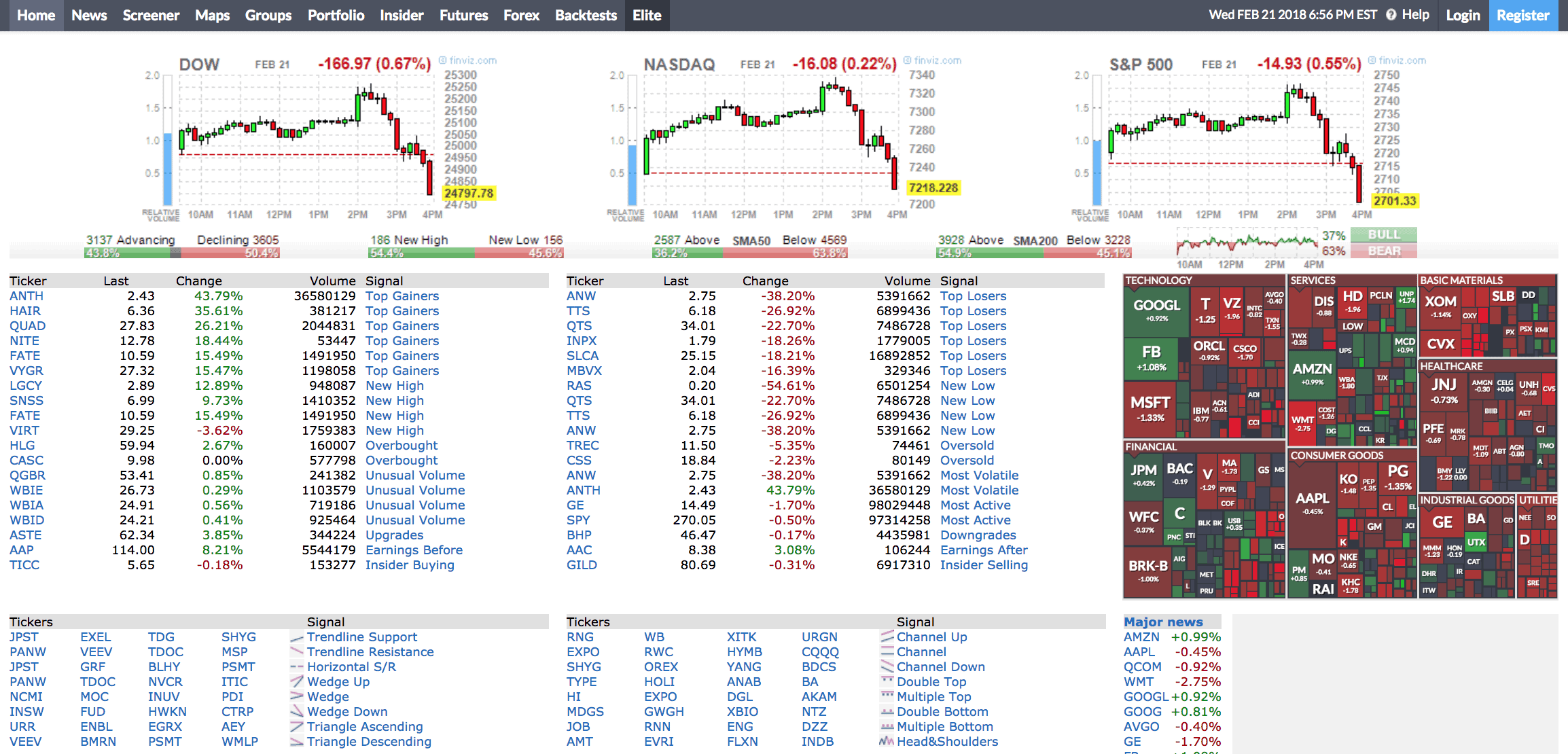

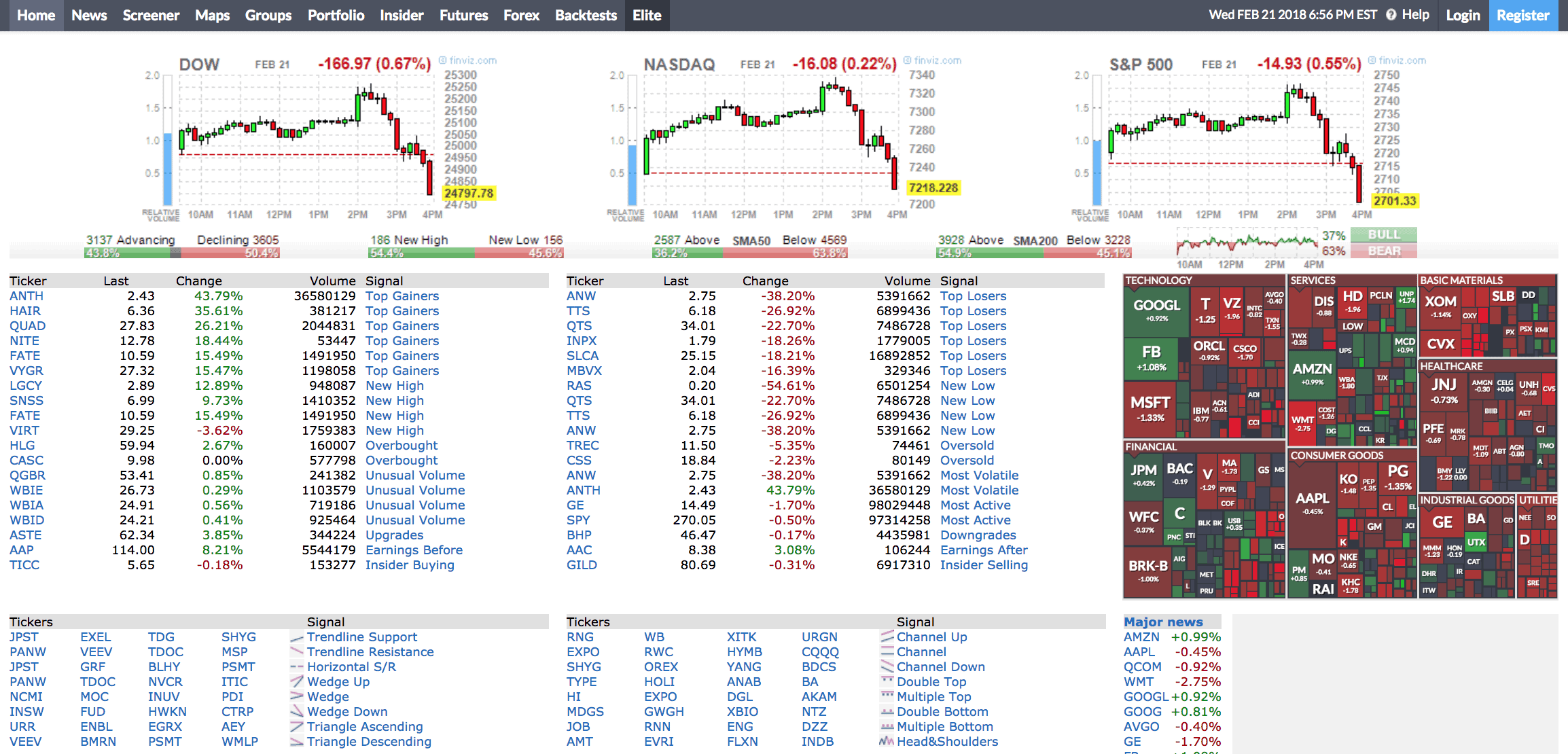

FinViz Overview

This is a stock market data website that has been around since 2005 so you can bet they’ve seen it all. You can access most of the FinViz features for free although an upgrade is required to benefit from real-time quotes.

TradingView Overview

TradingView is a social network designed for traders from all walks of life. So, whether you’re into stocks, cryptocurrency, forex, or even futures, this is the platform for you. The tool is designed to make it easier for you to discover investment ideas and interact with like-minded traders.

TradingView vs FinViz: A Comparison

The only way for you to understand how these two platforms compare is by looking at their specific features. Here we go:

1. Screener

Both screeners are quite well-made. FinViz, however, has a larger database of stocks with 7,000+ stocks vs 5000+ for TradingView.

As you can imagine, it’s hectic to dig through all that data without a filter. Fortunately, both companies do provide you with the means to filter the stocks e.g. through volume, industry, target price, sector, market capitalization, etc.

TradingView, however, seems to have an upper-hand as it offers advanced screening features for stocks, forex, and cryptos as well.

Don’t get us wrong. FinViz is good only that it doesn’t provide much depth as far as forex and cryptos are concerned.

So, let’s just say that FinViz is a better screener if you’re strictly into forex. But if you’re thinking about widening your investment portfolio, TradingView provides better flexibility.

2. Charts

Both platforms provide you with web-based charts. The beauty about that is that you get to access your charts easily and without having to download/install any software.

FinViz has some pretty decent charts complete with top-down analysis which is a very important feature if you ask us.

Another thing we love about the FinViz charts is that they provide real-time quotes (but only for paid subscribers). Plus, you get drawing tools and indicators all which come in handy when you need to land great trading opportunities.

While what FinViz provides is good, it’s TradingView that has the real deal as far as charting tools are concerned. TradingView charts provide you with all the tools and functionality you need – for free. Yup, you read that right.

The charts are fully customizable and allow you to add your favorite technical indicators as you’d wish.

3. Paper Trading

Are you a little bit afraid of pulling the trigger on your first stock purchase? Buying stocks by backtesting might be one of the best things you can do to learn how everything works. Plus, it gives you the opportunity to test-drive your trading strategy without putting real cash in.

The two services in review provide you with ample backtesting functionalities. The FinViz backtesting functionality has so far maintained a clean track-record.

The TradingView paper trading service has had its fair share of downside in the recent past. Fortunately, the team behind it fixed most of those anomalies, and currently this tool is firing on all cylinders.

4. News

Even the best-made technical analysis tools fail. Trading the news, therefore, should always be a key component of your investment strategy.

The good news is that these two stock pickers provide you with access to the latest news. They are not as comprehensive as Benzinga but they provide just enough updates to keep your technical analysis mission right on course.

FinViz normally relays news from CNN, Wallstreet Journal, Bloomberg, and CNBC. On the other hand, TradingView posts regular news updates from Yahoo! Finance.

None of these will suffice if you’re looking for a dedicated source of timely stocks news. That said, we feel that FinViz provides slightly better access to news than TradingView.

5. Heat Maps

Sometimes, in fact, most of the time, you don’t have the whole day to spend staring at charts and indicators. And that’s where heat maps come in handy.

They provide you with a bird’s eye view of the markets enabling you to know where the money is, easily.

FinViz provides what we think is the best stocks heat map available currently. TradingView currently provides forex heat maps.

So, if you’re exclusively into stocks trading, FinViz might be the better pick here.

6. Alerts

Good stock alerts tools notify you immediately significant changes take place in the stocks market (based on your preferred style of trading or portfolio). We cannot overemphasize the benefits of having a good alerts service.

As far as this battle frontier is concerned, TradingView comes out as the undisputed winner. The platform sends immediate notifications once the markets meet your criteria. For example, you can program it “Alert me once Amazon reaches $50.” And just like that, the system will send you notifications through:

- Push notifications

- SMS

FinViz only provides email notifications. It’s still not clear whether they have plans in place to roll out SMS and push notification features any time soon.

So, go for TradingView if you’re looking for assuredness that you will not miss any important happenings in the market. If you spend most of your time traveling, you’ll benefit a lot from this level of flexibility.

Needless to say, FinViz alerts work best if you spend most of your time in places with good internet connection.

7. Chat Room

When you trade alone, you’ve got nothing but your guts and tools to rely on. But when you tap into the benefits of a chat room, you get to leverage the power of interpersonal learning.

Chat rooms give you the opportunity to meet like-minded traders so you can learn from each other and even correct each other’s mistakes.

Sticking to the TradingView vs FinViz debate, only the latter has a chatroom. FinViz does not have a chatroom.

TradingView has one of the liveliest chatrooms for stock marketers that we have come across so far. However, like with any other busy market, it’s not unusual to run in to some trolls. Fortunately, you can always make good use of the “Ignore” button to secure your peace of mind.

8. Trading Courses

Few things will help build your day trading career as much as undertaking comprehensive training, particularly on trading strategies. Unfortunately, there isn’t much in the form of trading courses being provided by any of these two competitors.

That said, TradingView offers some basic trading courses touching on topics related to trading psychology, technical analysis, and cryptocurrencies.

FinViz has no trading courses that we are aware of.

9. Mobile Accessibility

Everything has gone mobile these days and you’d appreciate the convenience this kind of technology brings. Having a stock screener that can be accessed via mobile, is a good idea.

And so far, TradingView seems to be leading the charge with its iOS and Android apps. FinViz is still lagging behind on this front once again. There’s no mobile app for FinViz at the moment although their site is mobile-friendly.

This partly explains why are no push notifications for FinViz users.

10. Pricing

Most FinViz features are available free of charge. However, for obvious reasons, you end up with limited functionality if you opt for a free account. For example, you’ll get delayed quotes meaning you’ll be unable to make any meaningful trading decisions unless you’re a premium subscriber.

There’s only one tier to subscribe to if you opt for FinViz and that is FINVIZ*ELITE which costs $24.95 per month.

On its part, the TradingView family welcomes you aboard with a free-trial package. This is a limited-time package and it enables you to test-drive all the key features of the entire system.

You will, however, be required to upgrade your subscription or cancel it (after 7 days). If you’re satisfied with the service, you can opt for any of the three packages available.

The Starting package goes for $14.95 but to experience to full benefits of TradingView as discussed above, you’re better off opting for the premium package which costs $59.95. That’s not cheap at all!

Conclusion

We don’t have a clear winner here because both platforms are quite well-made. If you’re looking for a feature-rich service, consider investing in TradingView. The screener provides you with all the little tools you need to grow as a trader.

But if all you’re looking for is a tried and tested scanner with a bit of news, FinViz provides better value for money. For just 24 bucks per month, you’ll access premium services – not cheap but reasonably priced in our view.

So, the ball is now in your court. Armed with all the details we’ve provided in this FinViz vs TradingView face off, we hope that you’ll be able to make an informed choice.

Trading Review’s mission is to help you become a better and smarter trader/investor through in-depth reviews of courses, trading software, and more.